Business growth often hinges on having the right financial resources at the right time. Whether you?re launching a new product, expanding operations, or covering unexpected expenses, access to business funding can make all the difference. With quick funding options ranging from $5,000 to $100,000, your business can move forward confidently, unhindered by the delays and constraints of traditional lending.

Key Points

- Fast funding from $5,000 to $100,000 with no collateral required

- Approval within 72 hours for immediate cash flow support

- Ideal for small businesses and startups looking for agile funding solutions

Why Fast Business Funding Matters

Securing funding quickly is crucial for businesses ready to grow, adapt to market demands, or overcome cash flow challenges. While traditional loans often require extensive paperwork, collateral, and a lengthy approval process, quick funding solutions allow you to take advantage of opportunities without the roadblocks. This funding approach offers an efficient path to capital, helping you focus on what matters ? your business growth.

Business funding empowers entrepreneurs to focus on growth and innovation rather than financial barriers.

Traditional vs. Quick Business Funding: Choosing the Right Path

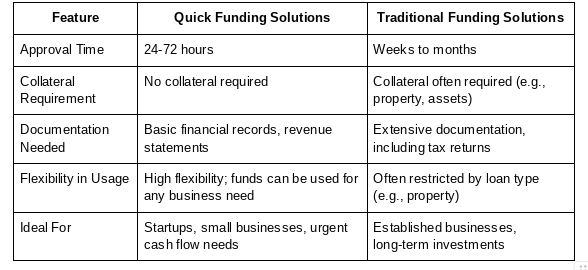

Traditional funding methods, while reliable, come with their own set of limitations that can hold back business owners, especially when time is a factor. Here?s a quick look at the differences:

Traditional Funding Options (Overview)

- Bank Loans: Often require extensive documentation and collateral, with approval processes that can last weeks or even months.

- Small Business Administration (SBA) Loans: Partial government backing with lower rates, but eligibility requirements can be restrictive, with approvals typically taking a significant amount of time.

- Venture Capital: An option for high-growth startups but often requires giving up equity, which might not be ideal for every business.

While these options may work for established businesses with more time to plan and meet stricter criteria, they can be a challenge for entrepreneurs needing capital quickly.

The Advantage of Quick Funding

Quick business funding, by contrast, is designed to be efficient, accessible, and fast, allowing businesses to move forward without delay. This funding solution offers:

- Fast Access to Capital: With approvals in as little as 72 hours, you can quickly secure the funds needed to fuel immediate opportunities or cover urgent expenses.

- Flexible Usage: Funds can be used as you see fit ? whether it?s investing in marketing, scaling production, or maintaining operations.

- No Collateral Requirement: Without the need for assets as collateral, small businesses and startups can access funding without the risks associated with traditional loans.

This funding approach provides the strategic edge many businesses need to thrive in competitive markets.

The Power of Quick Funding: Benefits That Drive Business Growth

With flexible, fast funding options, you can focus on driving growth without the long wait times or asset requirements associated with traditional loans.

Success Stories: Quick Funding in Action

Quick business funding has fueled growth for a variety of businesses, from tech startups to retail giants, by providing the flexibility to respond to demand, scale operations, and make strategic investments without delay. This agile funding approach has helped these companies capitalize on opportunities that might have otherwise slipped away.

Consider these examples:

- Dollar Shave Club: Known for disrupting the razor industry with its direct-to-consumer model, Dollar Shave Club used fast funding to expand its marketing reach, allowing the brand to grow rapidly and capture market share. Quick access to capital enabled them to ramp up production, deliver on growing demand, and launch bold marketing campaigns ? ultimately leading to its acquisition by Unilever for $1 billion.

- Blue Apron: This meal kit delivery service leveraged quick funding to streamline its supply chain, expand customer service capabilities, and scale marketing efforts. With the additional funds, Blue Apron could maintain fresh inventory, improve distribution speed, and enhance customer experience during peak demand periods. Quick funding helped Blue Apron meet rising consumer interest in meal kits, propelling it toward a successful IPO.

- Casper: The online mattress retailer Casper took advantage of fast funding to fuel its growth from a startup to a well-known brand. Quick access to capital allowed Casper to invest in product development and nationwide advertising, creating widespread brand recognition. Funding enabled them to meet high customer demand and expand product offerings, setting them apart in the competitive mattress industry.

- Zoom: During the COVID-19 pandemic, Zoom experienced an unprecedented surge in demand. The company relied on rapid funding to support server expansion, improve infrastructure, and hire additional staff to meet the massive influx of users. Quick funding allowed Zoom to adapt swiftly, ensuring a stable, reliable platform during a critical time, which solidified its position as a leader in video conferencing.

These examples demonstrate how strategic quick funding empowers businesses to respond to market demand, expand at the right moments, and strengthen their market position. Rather than waiting on lengthy approval processes, these companies could take advantage of timely funding to achieve growth, reach new audiences, and stay competitive.

Quick funding?s potential lies in its ability to empower you to make impactful business moves without hesitation. This product provides the insights and strategies needed to leverage fast funding for sustainable growth, offering you the tools to position your business for immediate and long-term success. With expert guidance, you?ll learn how to make quick funding a cornerstone of your business strategy.

How Quick Funding Transforms Business Potential

Quick funding is more than just fast access to cash; it?s a strategic advantage that empowers business owners to move forward with confidence. With the ability to access funds within 72 hours, businesses are no longer held back by cash flow delays or unexpected costs. This flexibility allows entrepreneurs to pivot, scale, or seize new opportunities without the financial constraints that often slow down growth.

Consider the possibilities that quick funding opens up:

- Launching New Products: When a new product is ready for launch, timing is everything. Quick funding provides the capital needed to cover production, marketing, and distribution costs, allowing you to bring products to market faster and capture demand when it?s at its peak.

- Scaling Operations: As demand grows, so does the need for resources. Quick funding enables you to scale operations ? whether it?s hiring more staff, purchasing additional inventory, or upgrading equipment ? to meet customer needs without interruptions.

- Covering Unexpected Costs: Emergencies and unforeseen expenses are inevitable in business. Quick access to funding acts as a safety net, helping you navigate unexpected challenges like repairs, sudden market shifts, or urgent project costs, ensuring continuity and stability.

- Enhancing Marketing Efforts: For many businesses, visibility is key to growth. Quick funding allows you to ramp up your marketing efforts, invest in targeted advertising, and boost brand recognition when it matters most, helping you reach new customers and increase revenue.

- Building Financial Resilience: With fast funding available, businesses can create a buffer to protect against economic downturns, seasonal slowdowns, or cash flow gaps. This resilience helps maintain operations and support growth even during challenging periods.

Quick funding?s impact lies in its ability to empower you to make bold, growth-oriented decisions without hesitation. This product offers comprehensive guidance on maximizing these opportunities and ensures your business is financially prepared for both immediate needs and long-term success. With expert insights and a clear approach to funding, you?ll be equipped to leverage quick funding as a strategic tool for sustained growth and resilience.

Concluding Note

Your business deserves the resources to succeed, and quick business funding provides the agility to make it happen without the limitations of traditional financing. Explore your funding options and discover the ideal solution to fuel growth, manage expenses, and take your business to new heights. As a part of the Winners Tribe, remember to take advantage of resources, insights, and community support available to you. And if you?re not yet a member, join the Winners Tribe and connect with other ambitious entrepreneurs dedicated to success.

With the right funding and the right network, your business is ready to thrive.

Join the webinar here

FAQs

Who is eligible for fast business funding?

- Any business, whether new or established, looking for quick capital without collateral is eligible.

How long does the approval process take?

- Approval can be completed within 72 hours, allowing you to access funds quickly.

Is collateral required for this funding?

- No, this funding option does not require collateral, making it accessible for all businesses.