A steady, passive income stream offers the kind of financial freedom many of us work hard to achieve. With the right approach, turning this goal into reality doesn?t have to be complicated. An effective online income blueprint can help set up a system where your earnings grow, even during downtime. By diving into the mechanics of income automation, we?ll show how to create a self-sustaining income stream that supports your financial independence over time.

Step into a world where your income works for you 24/7. We'll show you how to create a blueprint for your desired lifestyle, not just for earning money. This blueprint unlocks the power of income automation?a strategy that, with dedication and patience, brings us closer to financial freedom and the life we dream of.

Key Takeaways

- An insight into turning the dream of passive income into achievable milestones.

- Understanding how an online income blueprint serves as your financial GPS toward independence.

- The importance of crafting a hands-off income automation system to gain freedom.

- A glance at the exciting potential for financial growth without active daily involvement.

Understanding Income Automation and Its Potential

Income automation has transformed how we earn, enabling more to achieve financial freedom. It creates systems that generate income with minimal daily effort. We'll delve into the essence of income automation and its role in securing financial stability.

The Basic Principle of Income Automation

Income automation is about setting up processes that generate passive income with little to no daily involvement. This can include digital products that sell themselves or investments that yield regular dividends. For further guidance, you can explore the Income Automation Blueprint.

Why Automating Your Income Can Lead to Financial Freedom

Adopting automated income is more than saving time; it's about building a secure financial base. This approach allows you to focus on personal development, family, or wealth-building ventures, freeing you from a traditional 9-to-5 job.

Therefore, income automation is not just convenient; it's a transformative strategy. It empowers you to focus on what's truly important while continuously growing your wealth. Explore our guide for deeper insights into automating your income.

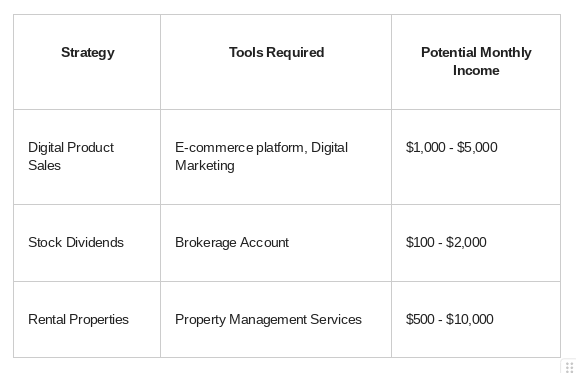

The table shows various income automation strategies, each with its tools and potential earnings. Adopting these can significantly advance you towards financial freedom, making your dreams a reality.

Setting Your Passive Income Goals

Starting your journey to financial independence through passive income requires more than just enthusiasm. It demands precise planning. Achieving your financial goals means setting realistic targets that match your personal dreams and financial capacity.

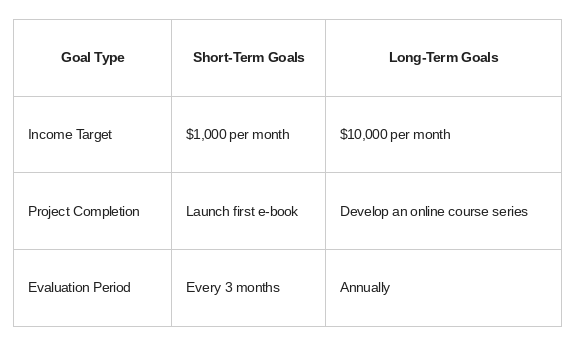

To smoothly transition and boost your efficiency in creating revenue streams, setting clear, actionable goals is key. Let's explore how to effectively establish these goals.

- Define what financial independence means to you. Everyone has a unique vision of financial freedom. Specify if it means having enough to cover necessities, securing a luxurious lifestyle, or perhaps a bit of both.

- Assess your current financial status. Knowing your starting point is essential to mapping out your journey. This involves understanding your current income, expenses, debts, and savings.

- Set specific passive income targets. Rather than vaguely aiming to make "more money," it's vital to set specific revenue numbers you wish to achieve monthly or annually through your revenue streams.

- Create a timeline. Setting a timeline not only for achieving your goals but also for periodic evaluations helps keep your passive income efforts on track.

As we move forward, it's crucial to remember that flexibility in our goals is key. It allows us to adapt and refine our strategies for achieving our financial goals. Regularly reviewing these goals ensures they remain relevant to our changing financial situation and personal aspirations.

The Role of Online Business in Income Automation

In today's digital age, building a strong online business foundation is key to unlocking passive income potential. By exploring different online business models, you can automate your income. This approach leads to a more flexible and resilient financial future. Discover more here.

Different Models of Online Business for Automation

Several online business models are ideal for automation. E-commerce stores can use drop-shipping, where the supplier handles fulfillment. This lets the business owner focus on scaling operations. Affiliate marketing is another model, where you earn passive income by promoting others' products and getting a commission for sales.

- E-Commerce with Drop-shipping

- Affiliate Marketing

- Digital Products and Courses

- Subscription Services

These models lay the groundwork for a sustainable online business foundation that generates passive income with minimal ongoing effort.

Success Stories in Online Business Automation

Many entrepreneurs have leveraged online business models to achieve financial independence. For example, owners of successful drop-shipping stores have streamlined their operations. They now manage their business with just a few hours of work each week. Similarly, creators of popular online courses have automated their sales and customer service. This allows them to focus on creating new content or exploring other ventures.

These success stories not only inspire but also offer actionable insights. They show the methods and technologies that can automate an online business. This reinforces a robust online business foundation for passive income.

Creating a Robust Online Business Foundation

Building a solid online business foundation is key to success. It's not just about picking the right products or services. It also means setting up a digital infrastructure that supports growth and scalability. Let's explore the essential steps to lay this foundation, ensuring your venture thrives and generates sustainable online income.

- Niche Identification: Begin by finding a niche that matches your interests and market needs. This focused approach enables you to craft targeted strategies for your online business.

- Website Creation: Your website is your online home. Invest in a professional, user-friendly design that reflects your brand and makes navigation easy.

- Content Strategy: Create a content strategy that draws and keeps customer interest. High-quality, relevant content boosts your site's SEO, attracting more organic traffic.

- Customer Trust: Establish trust through clear communication, reliable customer service, and consistent value delivery. Trust is vital for retaining customers and converting leads into sales.

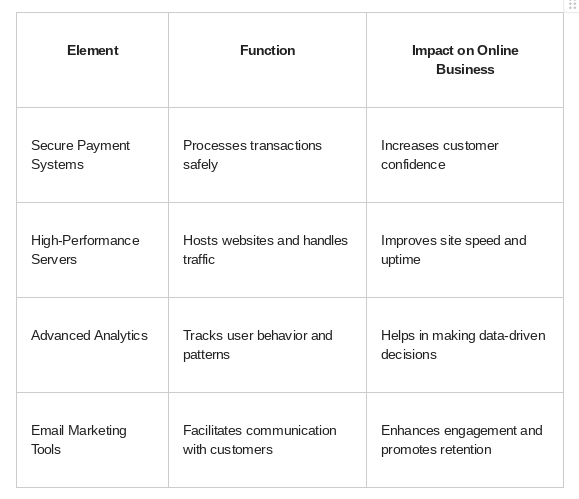

Additionally, a solid digital infrastructure is essential. This includes secure payment gateways and robust CRM systems for effective customer relationship management. Each part of this infrastructure is crucial for shaping your online income blueprint.

Here's a quick look at the key elements that form the backbone of a successful online business platform:

Creating this robust framework strengthens your online business's operational core. It also enables you to adapt and succeed in a competitive digital market. In short, a well-built online business foundation backed by a strong digital infrastructure is crucial for a profitable online income blueprint.

Diverse Revenue Streams for a Stable Online Income

In today's economy, financial stability is crucial. Diversifying your revenue streams is key. By exploring different passive income opportunities, you can build a more stable and sustainable online income system.

Combining Multiple Streams for Increased Stability

Integrating multiple revenue streams is like building a financial safety net. It protects you from market unpredictability. Whether through affiliate marketing, e-commerce, digital products, or investments, each stream supports your financial structure. This reduces your reliance on a single source.

Identifying Passive Income Opportunities

Spotting new passive income opportunities requires staying informed about trends and technology. Keeping up with industry changes and innovations can reveal profitable niches. Early engagement in these areas can lead to significant long-term gains.

The aim of diversifying isn't just to have various income sources. It's about building a sustainable strategy for financial stability. This ensures a steady income flow through different channels and economic cycles.

Leveraging Digital Infrastructure for Automated Income

In today's digital age, a solid digital infrastructure is key for automated income systems. These systems must be efficient, scalable, and flexible. Advanced income automation tools help individuals and businesses achieve automated income without constant manual oversight.

Tools and Technology to Build Your Automation System

Starting your journey to automated income requires the right tools. Automation software is central, enabling users to streamline various tasks, from email marketing to CRM. Analytics tools also play a crucial role, offering data insights for better decision-making and strategy optimization.

Key Digital Infrastructure Components

A strong foundation includes several digital infrastructure components. Reliable hosting services are essential for keeping your online platform running smoothly. E-commerce platforms offer a seamless shopping experience, while secure payment processing systems ensure quick and safe transactions.

By setting up these components, you can create a digital machine that efficiently generates automated income.

The success of your automated income efforts depends on the effectiveness of your tools and infrastructure. Implementing these with precision and foresight will pave the way to financial automation and freedom.

Strategic Investment: Spending Money to Make Money

In the world of income automation, the efficient use of strategic investment is crucial to unleashing your business's full potential. By allocating funds wisely towards the right tools and resources, you not only streamline your operations. You also significantly enhance your passive income opportunities.

Investing in high-end marketing tools and premium content creation services can seem intimidating initially. However, it's essential to remember that these investments empower your business to generate consistent revenue streams. Let's take a deeper look at how spending money strategically can actually make you money in the realm of online entrepreneurship.

- Bringing in experts to fine-tune your digital strategy enhances your market reach and effectively capitalizes on passive income potentials.

- Utilizing advanced analytical tools helps in understanding customer behavior, thus maximizing return on strategic investments and refining your revenue streams.

- Upgrading technical infrastructure ensures your business can scale efficiently, supporting larger volumes of transactions and interactions without compromising on speed or security.

We must approach the concept of "spending money to make money" with a calculated mindset. We prioritize investments that offer not just immediate gains but also pave the way for sustainable growth. This approach to strategic investment doesn't just boost our current operations. It sets a solid foundation for future revenue streams.

- Analyze the current market trends: Understanding what tools, platforms, and strategies are delivering real results.

- Invest in scalable solutions: Technologies and services that can grow with your business are paramount.

- Monitor and optimize: Continuously tracking the performance of your investments ensures that every dollar spent is contributing to your bottom line.

In summary, through careful and informed strategic investment, we can tap into the vast potential for generating reliable passive income. It's all about making smart choices today that will lead to profitable revenue streams tomorrow.

Passive Income: Myths vs. Reality

Starting your path to financial freedom often begins with grasping passive income. Yet, many passive income myths can mislead you. We'll debunk these myths and outline realistic expectations for lasting financial independence.

Busting Common Myths About Passive Income

One common myth is that passive income needs no effort. In reality, it requires a lot of setup and continuous tweaking. Another myth is that it promises instant wealth. This overlooks the gradual growth typical of genuine income streams.

Realistic Expectations and Timeframes for Income Automation

It's vital to have realistic expectations. Achieving financial independence through passive income is not immediate. It's a slow, steady journey, based on smart planning and consistent work.

- Dedication to ongoing management

- Patient capital growth

- Adaptability to market changes

In conclusion, the path to passive income is not mythical or mystical; it's a practical business approach. Let's aim for achievable goals and solid plans to reach true success.

Maintaining and Scaling Your Automated Revenue Streams

To keep your online business thriving, it's essential to stay current with market trends and tech advancements. We explore effective strategies for preserving and growing your revenue streams. This ensures your passive income continues to increase.

- Regular System Updates: Ensuring your digital tools and platforms are up-to-date is crucial for efficiency and security.

- Market Trend Analysis: Grasping market dynamics allows you to seize new opportunities and adapt effectively.

- Reinvestment Strategies: Investing a part of your earnings back into your business can drive growth and innovation.

While these practices are vital, it's equally important to track your financial flow through regular analysis. This is the cornerstone of passive income growth. Here, we present the financial outcomes from scaling online businesses effectively:

By closely monitoring and adjusting your strategy, you can significantly boost your business's passive income generation. Remember, continuous growth and adaptation in your online business are not just beneficial?they are essential for lasting success.

Measuring Success: Tracking and Optimizing for Maximum Earnings

In the fast-paced world of online income, success hinges on effective measurement and management. Today, we delve into proven methods for tracking automated income and optimizing for higher profits. These strategies are crucial for maximizing earnings and ensuring the efficiency of passive income streams.

Tools and Metrics for Tracking Automated Income

Grasping the performance of your automated income sources is vital for ongoing success. Utilizing advanced analytics tools offers precise insights into revenue streams. This allows us to pinpoint which areas excel and which need tweaking. Such a data-driven strategy is key to boosting earnings and optimizing passive income channels.

Key metrics include conversion rates, average earnings per user, and ROI from various channels. These metrics help us assess our setups' effectiveness. They guide us in refining our strategies to increase income.

A/B Testing and Optimization Techniques

A/B testing is a powerful tool in our optimization toolkit. It clearly shows which strategies succeed and which fail. By testing minor variations in our automated systems, we identify the most effective configurations. We then apply these winning models to other business areas to replicate success.

Optimization techniques are not just about boosting current earnings. They also focus on long-term growth and sustainability. Regular updates and revisions, based on systematic A/B testing, significantly impact our revenue. They help us adapt to market changes and consumer behavior.

Through strategic tweaks and adjustments, we're not just tracking automated income; we're actively increasing it. Our automated systems are not only functional but also dynamically evolving with the competitive market.

Conclusion

Here?s a strengthened call to action with a hyperlink included:

As we conclude, let?s reinforce the essential steps to create your income automation blueprint. We?ve explored everything from understanding income automation to setting achievable goals, selecting digital tools, and scaling your efforts. This journey has provided actionable steps to help anyone reach financial freedom through passive income.

The digital age is rich with opportunities to earn, invest, and grow wealth independently. With dedication and the right strategies, passive income can become a reality. Remember, this is a journey of ongoing learning and growth. Our mission is to empower you with the tools and knowledge needed to confidently build your automated income systems.

If you?re ready to put these insights to work, now is the time to act. Don?t wait?begin your journey to financial freedom today with the Income Automation Blueprint. Start creating systems that earn for you effortlessly, giving you the freedom to enjoy life, pursue passions, and connect with those you love. Your path to a financially secure future begins right here, with each intentional step you take.