Imagine turning your digital creations into assets that work for you 24/7. The digital economy is evolving, bringing a new chance: NFT creation as a passive income source. It's not just about selling; it's about creating assets that grow in value over time. This guide will show you how to create digital assets that attract financial growth through earning interest. We'll explore how to make assets that last, not just impress for a moment, opening up new opportunities for artists, investors, and collectors.

Join us on a journey through crypto artistry and smart investing. Here, passive income meets cutting-edge technology. Get ready to learn how to create NFTs that dazzle and grow your wealth. Welcome to the future of sustainable creativity and earning interest from your digital assets.

Key Takeaways

- Unlock the possibilities of earning passive income through NFTs

- Understand the intersection of art, technology, and smart investing

- Discover strategic methods for NFT creation that ensure ongoing financial returns

- Learn about the role of digital assets in stimulating financial growth

- Explore the fundamentals of earning interest from NFTs

Understanding NFTs and Their Role in Digital Economy

The emergence of NFTs has transformed our understanding of ownership and value in the digital realm. These non-fungible tokens are more than just digital novelties; they are foundational elements that enhance blockchain investing and increase NFT interest. They utilize blockchain's transparency and security to create trust and scarcity, essential for their value.

The Basics of NFTs

NFTs, or non-fungible tokens, signify ownership of unique digital items or concepts. Unlike cryptocurrencies, which are interchangeable, each NFT is distinct. This uniqueness is at the heart of NFT interest, as each token is linked to a specific digital or real-world asset, from art and music to videos and more.

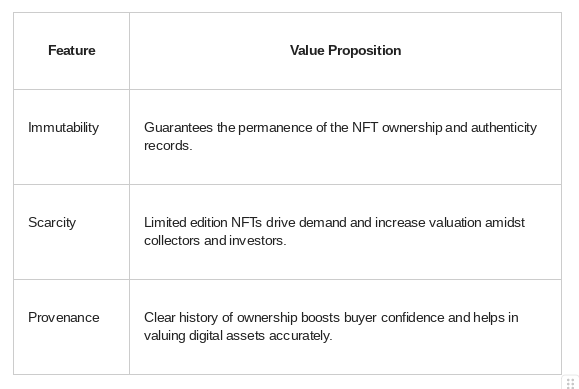

How NFTs Drive Value in the Digital Space

NFTs leverage digital scarcity, provenance, and ownership to establish their worth. They use blockchain technology's secure, immutable nature to ensure authenticity and prevent forgery. These attributes are crucial for collectors and investors in the blockchain investing realm.

In today's digital economy, grasping how NFTs function and the blockchain investing strategies behind them is essential. Recognizing the intrinsic values NFTs bring to the digital sphere enables stakeholders to make informed decisions. This ensures their active participation in this ever-evolving market.

Navigating the World of Blockchain for NFT Creation

In the ever-evolving realm of NFT creation, grasping the intricacies of blockchain investing is essential. Our mission is to lead you through the process of choosing the perfect blockchain platform. We will also cover the essential tools needed for crafting impactful digital assets.

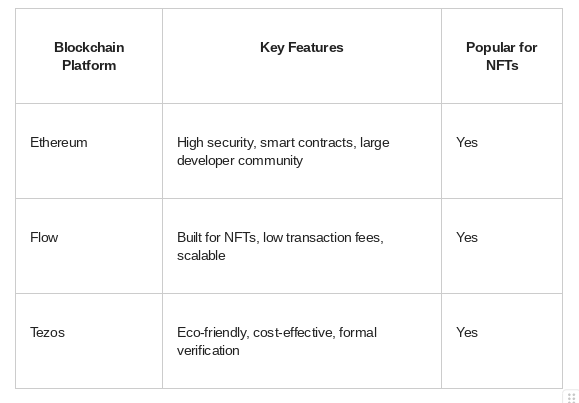

Choosing the Right Blockchain Platform

The blockchain you select can greatly affect your NFTs' functionality and appeal. Some platforms excel in scalability, while others prioritize security. It's vital to consider transaction speeds and costs to optimize your digital asset investment.

Tools and Resources for Creating Your NFT

Starting your NFT creation journey requires a variety of tools, from graphic design software to blockchain-specific applications for minting NFTs. Online tutorials, community forums, and development kits offer crucial support and information.

Strategies for Earning Passive Income with NFTs

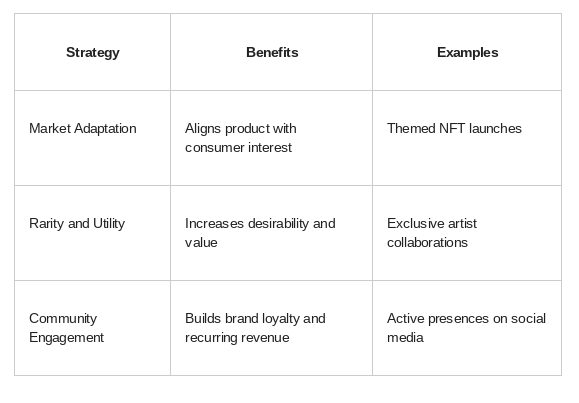

As creators of NFTs, we are always seeking new ways to generate passive income in the ever-changing digital art and collectibles landscape. One key strategy is to align our NFTs with current trends and audience preferences. This ensures a steady flow of financial growth and establishes a reliable source of automated income.

Adding rarity and utility to our NFTs boosts their value and attracts collectors and investors. Unique collaborations with artists or offering tangible rewards can significantly increase their appeal and worth.

- Identify emerging trends and niche markets early on

- Create exclusive or limited edition series

- Offer additional benefits like access to special events or physical items

Engaging actively with the NFT community on platforms like Discord and Twitter is also crucial. It fosters a loyal customer base and drives automated income through repeated sales and increased visibility.

By adopting these strategies, we can greatly improve our chances of earning passive income through NFTs. This ensures ongoing financial growth in the rapidly expanding NFT marketplace.

How to Generate NFT Interest for Financial Growth

In today's digital marketplace, establishing a strong presence can significantly enhance your NFT's visibility and popularity. We delve into actionable strategies that not only foster NFT interest but are vital for accelerating financial growth and earning interest.

Innovative Ways to Spark Interest

Innovation is key in the NFT space. By introducing interactive features or dynamic elements into your NFTs, you can engage a wider audience and create a memorable impact. These innovations encourage users to interact with your asset beyond a mere transaction, developing a deeper connection that boosts NFT interest.

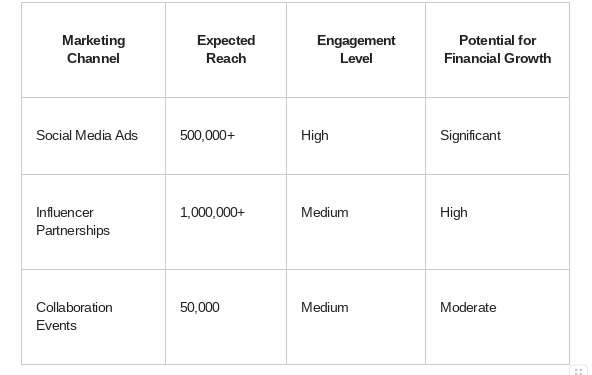

Marketing Tactics to Attract Buyers

To effectively reach your target market, implementing tested marketing tactics is crucial. Utilizing social media platforms to showcase your NFTs allows for direct engagement and feedback from potential buyers. Moreover, collaborations with well-known artists or influencers can leverage their followings, dramatically increasing visibility.

By employing these strategies, you can augment the NFT interest, grow your audience, and ultimately drive financial success. Remember, the key to effective digital marketing lies in creativity, adaptability, and understanding the unique demands of the NFT market.

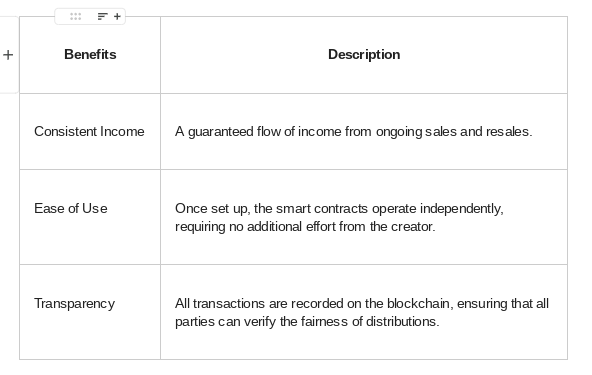

Automated Income: Smart Contracts and Royalties

The digital art and collectibles world has seen a significant shift with the advent of smart contracts and royalties. This innovation ensures a steady flow of automated income for creators. It also guarantees ongoing compensation each time an NFT is sold. Let's explore how smart contracts can be used to generate consistent financial gains.

Smart contracts are self-executing agreements with their terms encoded in code. These digital protocols enforce and execute agreements automatically when specific conditions are met. For artists and developers in the NFT realm, smart contracts are transformative. They can be programmed to automatically distribute royalties upon each sale or resale, establishing a reliable source of passive income.

Consider a scenario where an artist creates a digital piece and a collector sells it later. Smart contracts ensure a predetermined royalty percentage is automatically paid to the creator. This automation streamlines transactions and guarantees creators continue to profit from their work.

Establishing smart contracts might seem daunting, but today's platforms and tools make it accessible to all. The NFT marketplace offers substantial earning potential thanks to these advanced technologies. They support both creators and collectors, creating a transparent ecosystem where everyone benefits from secondary sales.

In summary, using smart contracts for automated income through royalties offers a powerful, efficient, and sustainable income model in the digital economy. It not only improves how artists and creators earn but also strengthens the digital art industry's economic model.

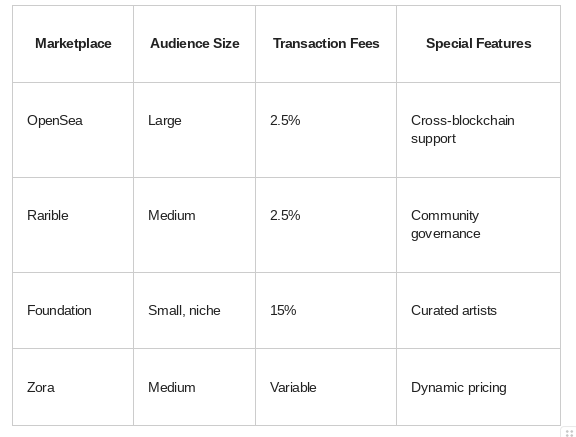

Maximizing Your NFT Earnings through Platform Selection

As blockchain investing enthusiasts, we grasp the vital role of choosing the right NFT marketplace in digital asset profitability. We'll explore how various platforms can affect your earnings. We'll also discuss key features that boost your NFT transactions.

Comparing NFT Marketplaces

Choosing the right NFT marketplace is more than listing digital assets. It's about finding a platform that meets your specific needs and boosts your blockchain investing exposure. We've compared several leading NFT marketplaces to guide you on where your digital assets might thrive most.

Importance of Platform Features in Earning Interest

Features beyond transaction fees and audience size are crucial in optimizing digital asset interest. Blockchain investing is ever-evolving. Being on a platform that updates and enhances its features can greatly impact your NFT's profitability.

Features like advanced search filters, analytics, and social sharing are now essential. They drive user engagement and make your NFTs more visible in crowded markets. Identifying the right features for your blockchain investing strategies can boost your success in NFT marketplaces.

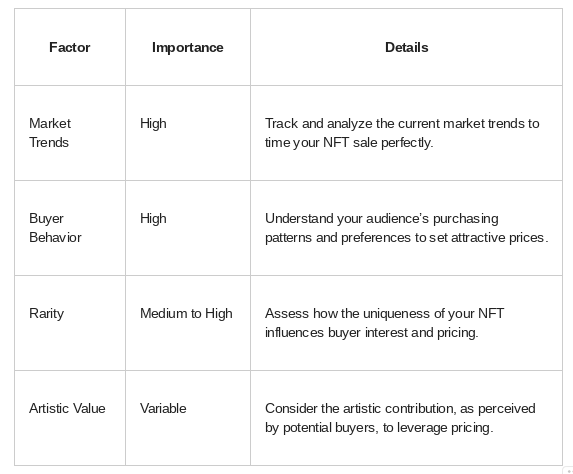

Best Practices for Pricing and Selling Your NFTs

The rise in NFT popularity highlights the importance of strategic pricing. This approach is crucial for maximizing returns from digital assets. We will explore how creators can determine the value of their digital creations and develop effective pricing strategies. These strategies aim to attract the right buyers.

Determining the Value of Your Digital Assets

Valuing digital assets is complex due to their unique nature. Originality, utility, artist reputation, and market demand are key factors. For NFT creators, understanding these aspects is essential for setting a realistic yet profitable price.

Tips for Competitive Pricing Strategies

Competitive pricing is vital for standing out in a crowded market. Analyzing market trends and adapting to buyer behaviors are crucial. Additionally, the rarity and artistic value of your digital assets should guide your pricing.

By combining these pricing strategies, NFT creators can boost their chances of successful sales. This approach ensures fair compensation for their innovative digital assets.

Assessing Risks and Managing Your NFT Investments

Exploring blockchain investing, we must acknowledge the importance of risk assessment for NFTs. The digital asset landscape is inherently unpredictable, with volatility a constant presence. Recognizing market conditions is crucial for financial growth, allowing us to predict trends and adjust our strategies. NFTs, like traditional assets, are influenced by market supply and demand, impacting their value and interest rates.

Grasping these dynamics is essential for effective portfolio management.

Investing in NFTs also requires us to consider legal aspects of blockchain investing. Although the technology is groundbreaking, laws and regulations are still evolving. It's our duty to stay updated on legal developments to safeguard our NFT interests. Additionally, diversifying our investments can help mitigate risks. By spreading our assets across various NFTs and blockchain platforms, we can protect ourselves from losses tied to a single investment.

In conclusion, our approach to blockchain investing and nurturing NFT interest must be based on careful consideration and diligent management. By keeping abreast of market conditions and legal changes, and implementing risk mitigation strategies, we foster sustainable financial growth. Take your understanding of NFT investing to the next level as a member, equipping yourself with knowledge and tools to navigate and thrive in the evolving digital asset landscape.

FAQ

What are NFTs and how do they generate passive income?

NFTs, or Non-Fungible Tokens, are digital assets that represent ownership of unique items or content on the blockchain. They generate passive income by offering creators the ability to earn royalties from future sales. This is done through smart contracts that govern these transactions automatically.

Can I create an NFT with no prior knowledge of blockchain technology?

Yes, today's tools and platforms make it possible to create NFTs without needing to be a blockchain expert. Many platforms offer user-friendly interfaces and resources to guide you through the NFT creation process.

What should I consider when choosing a blockchain platform for NFT creation?

When choosing a blockchain platform, consider transaction costs, environmental impact, community support, ease of use, and compatibility with your digital assets. Each platform has unique features and benefits.

How important is marketing in generating NFT interest and financial growth?

Marketing is crucial as it helps create awareness and demand for your NFTs. Effective marketing tactics can attract buyers and collectors. This leads to increased visibility, interest, and potentially higher financial returns.

What strategies can I use to earn passive income with NFTs?

To earn passive income with NFTs, create compelling content and consider special features like access to events or additional rewards. Ensure your NFTs have a degree of scarcity. Engage with NFT communities to build interest and leverage secondary sales for royalties.

How do smart contracts contribute to automated income from NFTs?

Smart contracts are self-executing contracts with terms directly written into code. They automate the process of earning royalties. This ensures you receive a percentage of sales whenever your NFT is sold in the secondary market.

What features should I look for when selecting an NFT marketplace?

Look for marketplaces with a large user base, low fees, strong security measures, and an easy-to-use interface. Also, consider supportive communities and features that align with your NFTs. Some platforms offer creator funds or promotional opportunities.

How do I determine the right price for my NFT?

Research the market to understand the pricing of similar NFTs. Factor in your creation costs and perceived value. Consider the utility and rarity of your NFT. Use a competitive pricing strategy that balances profit with attractiveness to potential buyers.

What risks should I be aware of when investing in NFTs?

Be aware of market volatility, the liquidity of your NFTs, potential copyright infringement, and fluctuating demand for digital art. Always perform due diligence and consider diversifying your portfolio to manage risks effectively.